134

In times of economic turmoil, corporations’ roles and purposes are often questioned. While profit is crucial, many argue that corporations also have a social responsibility to improve the world. It is where the concept of Environmental, Social, and Governance (ESG) comes into play. ESG encapsulates the idea that corporate strategies should not only be financially sound but also consider their influence on the environment and society and prioritize good governance practices providing ideal business models.

ESG - Environmental Social And Governance

Environmental, Social, and Governance (ESG) standards help organizations improve and hold themselves more accountable for their environmental impact, civic responsibility, and organizational governance. Each ESG indicators are significant, and its metrics are described by:

Environmental: The “E” in ESG represents how companies manage their environmental impact. This metric includes a company’s carbon emissions, which can be broken down into direct emissions (Scope 1), emissions from energy acquisition and use (Scope 2), and emission levels from the supply chain network (Scope 3). Other environmental considerations include greenhouse gas emissions, waste management, the company’s impact on air and water quality, energy efficiency, and biodiversity loss.

The interesting part is that we can evaluate LOCOMeX’s unique project-based ESG risk scoring tool, which provides auditable investment-grade ESG and Scope 3 emission reporting data.

Social: The “S” in ESG stands for how an organization treats its employees and the communities in which it operates. Social cues include employee and community participation, worker health and safety, human rights, diversity and inclusion, social and climate risks, and conflict minerals audits.

Governance: The “G” in ESG implies governance, which refers to an organization’s internal control systems, policies, and methods for mitigating and responding to violations. Non-financial reporting standards, regulatory compliance, responsible taxation, board composition, financial performance, executive compensation, shareholder rights, ethics, corporate investigations, sustainable supply chain management, product quality, cybersecurity, and data management are all part of how they establish ESG governance.

The Significance of Small and Medium-sized Businesses (SMBs)

- Small and medium-sized Enterprises(SMEs) put a lot of effort into developing innovative products and services, which enables them to respond to market changes more quickly. SMEs are critical in shaping a country’s economy. They are an appealing and massively innovative system.

- SMBs foster a competitive edge in product design, cost structure, and quality. Large enterprises would dominate almost all activity areas if SMEs did not exist.

- The governments also recognize the significance of small and medium-sized enterprises. Hence, they offer regular incentives to SMEs, such as easier debt access and better tax payments.

Implementing ESG For Long-Term Growth Strategies

Small and medium-sized Businesses (SMBs) play a pivotal and distinctive role in global ESG management.

Furthermore, SMEs are defined differently in different parts of the world. The country in which a company operates determines the defined size of an SME. Depending on the country, a company’s size or classification as an SME can be based on various factors: Annual sales, the number of employees, the number of assets owned by the business, climate mitigation targets, or any combination of these features are examples of characteristics.

The World Bank states that SMEs “represent about 90% of businesses and over 50% of employment globally.”

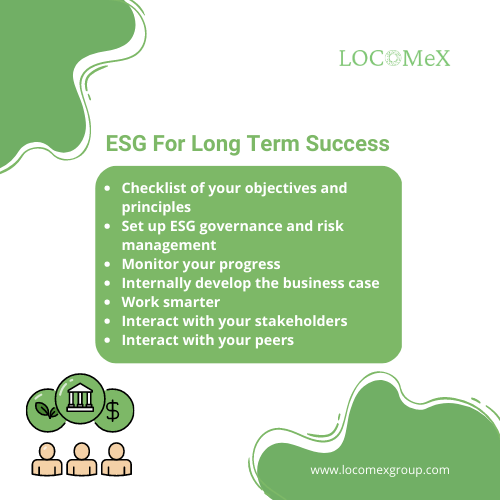

Checklist For Implementing ESG For SMB's

ESG reporting standards and regulations are gaining traction and will impact SMEs directly and indirectly. To become ESG systems companies, SMEs must advance their ESG initiatives and reduce their greenhouse gas emissions.

Moreover, in an interview, SMEs Crawford warned that pursuing regulatory compliance and competitive ESG performance can involve significant investments of time and money — especially for a small or medium-sized enterprise (SME).

Here is a snippet of what he advises for SMBs:

- Make a checklist of your objectives and principles: To effectively integrate ESG principles into your organization, it is important to establish clear objectives and principles. It can be done by examining your organization’s mission and aligning it with your ESG goals. Also, follow the United Nations Global Compact’s environmental, human rights, labor, and anti-corruption principles. It is recommended to conduct regular ESG materiality assessments, which will help you avoid business risks and make informed decisions accordingly. By following these steps, you can establish a strong foundation for your organization’s ESG efforts, ensuring a sustainable business.

- Set up ESG governance and risk management: Effective oversight of risks and performance is essential for the success of SMEs. It can be achieved by forming dedicated ESG committees or assigning ESG responsibilities to the existing board and senior management committees. Integrating ESG considerations, such as climate change, represent risks into Enterprise Risk Management (ERM) systems and processes will help increase resilience and ensure these important issues are effectively addressed.

- Start monitoring your progress: First, get hands-on with the reporting framework and then collect data to establish baseline performance. SMEs Crawford warned that the data you report externally must be investor-grade, comparable, and collected through auditable processes.

- Internally develop the business case: Crawford suggests the small business conduct an internal audit of its ability to report externally by ESG reporting standards. Invite and rely on the finance team to help with this endeavor. “They have a strong familiarity with processes and controls, and their opinion is valued by senior leadership,” he said.

- Work smarter: After establishing baseline performance, you can begin setting targets and risk tolerances, developing critical data processes and controls, and improving overall corporate social responsibility. It’s wise to deploy as many data collection and reporting processes as possible using risk and ESG data management systems.

- Interact with your key stakeholders: Begin engaging with the best suppliers and customers as you get your house in order. Provide opportunities for suppliers to learn about key issues and to see the business case for ESG value creation. The information you have gathered about your new initiatives’ risks and benefits will help you create value and make optimal investment decisions.

- Interact with your peers: Keep growing by becoming a member of and supporting the appropriate groups, initiatives, and industry associations. Collaboration with suppliers and customers to support progressive sustainability legislation comes into play here for sustainable business.

Step Up Your Business with LOCOMeX

SMBs face unique challenges when implementing Environmental, Social, and Governance (ESG) practices, but it is crucial for their long-term success. SMEs need to make consistent progress in building their ESG capacity and integrating these practices into their operations.

LOCOMeX offers a solution to help SMEs meet these challenges. Our best supplier software and ESG benchmarking tool are designed to help businesses digitally transform their data management, creating a centralized repository for ESG data that is easy to collect, exchange, and use. Our platform also ensures that ESG data, workflows, and risk oversight reporting are efficient and auditable to provide clear decision-making guidance.

Take advantage of the opportunity to take your business to the next level by integrating ESG practices into your operations. Contact our experts today to learn more about how LOCOMeX can help.